- You have no items in your shopping cart

- Subtotal: $0.00

Energy Arbitrage vs. Demand Response: As renewable energy adoption grows and electricity markets become more dynamic, two strategies are gaining importance: energy arbitrage and demand response.

Both approaches help stabilize power grids and reduce costs, but they work in very different ways. If you read our guide on energy arbitrage, you already know it’s about shifting electricity across time. In contrast, demand response focuses on reducing or adjusting electricity use during peak demand periods.

In this post, we’ll break down the differences, benefits, and challenges of these two approaches—and show where each fits best.

What is Energy Arbitrage?

Energy arbitrage is the process of:

- Charging (buying electricity) when prices are low (often during the night or midday solar surplus).

- Storing that energy in a battery or other storage system.

- Discharging (selling electricity) when prices rise during peak hours.

Think of it like buying low and selling high—but with electricity. Energy storage systems (ESS) and battery energy storage systems (BESS) make this strategy possible.

👉 More details here: What is Energy Arbitrage?

What is Demand Response?

Demand response (DR) is different. Instead of shifting stored energy across time, it’s about reducing or shifting electricity demand during critical hours.

Here’s how it works:

- Utilities send signals to businesses or consumers during times of grid stress.

- Participants lower their electricity use—for example, turning off industrial equipment, dimming lights, or reducing HVAC loads.

- In return, they receive financial incentives or reduced rates.

Demand response is like being a good neighbor: instead of putting more power into the grid, you help by using less power when the grid needs relief.

Key Differences: Energy Arbitrage vs. Demand Response

| Feature | Energy Arbitrage | Demand Response |

|---|---|---|

| Goal | Store cheap electricity and sell/use it later | Reduce load during peak or emergency events |

| Method | Uses batteries or storage systems | Adjusts or reduces electricity consumption |

| Revenue Model | Earns from price differences in electricity markets | Earns from utility incentives or avoided peak charges |

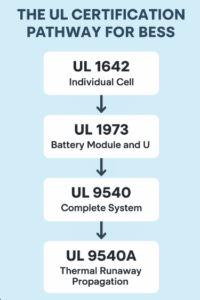

| Technology Required | Battery Energy Storage Systems (BESS) | Smart meters, demand control systems, flexible operations |

| Grid Role | Supplies stored energy | Reduces strain by lowering demand |

| Best For | Businesses with BESS, renewable integration | Factories, commercial buildings, households |

Benefits of Each Approach: Energy Arbitrage vs. Demand Response

Benefits of Energy Arbitrage

- Maximizes renewable energy use (solar, wind).

- Creates revenue opportunities from market price swings.

- Improves grid stability with stored power.

Benefits of Demand Response

- Reduces blackout risks during peak demand.

- Cuts electricity bills by avoiding peak charges.

- Easy participation for businesses and consumers without big investments.

Challenges to Consider

- Energy Arbitrage: Requires expensive batteries, efficiency losses, and depends on market volatility.

- Demand Response: Participation may disrupt normal operations, and incentives vary by region and utility.

Conclusion

Both energy arbitrage and demand response are crucial for the future of energy.

- Energy arbitrage shifts electricity across time, storing cheap energy and releasing it when valuable.

- Demand response reduces demand during stress hours, helping balance the grid quickly.

For businesses and utilities, the best strategy often combines both approaches—maximizing energy savings while supporting renewable integration.

FAQ: Energy Arbitrage vs. Demand Response

Q1: Can a company use both energy arbitrage and demand response?

Yes. Many large businesses use storage for arbitrage while also participating in demand response programs. This combination maximizes savings and supports grid stability.

Q2: Which is cheaper to adopt—energy arbitrage or demand response?

Demand response is usually cheaper since it requires no batteries or major infrastructure. Energy arbitrage involves higher upfront costs because it relies on battery storage systems.

Q3: Which approach supports renewable energy more?

Energy arbitrage directly supports renewable energy by storing excess solar or wind power for later use. Demand response helps indirectly by easing grid stress during renewable fluctuations.

Q4: Do both strategies provide financial benefits?

Yes. Energy arbitrage creates revenue from price differences, while demand response offers incentives or avoids peak charges, helping lower energy bills.

Q5: Are these strategies used globally?

Yes. Both are widely adopted in the US, Europe, and Asia-Pacific, with policies and market structures shaping how they’re implemented.

[…] Maximize savings by combining DR with energy arbitrage strategies. […]